What is a checking account?

Simply put, a checking account is a place to store money. The term “place,” however, does not refer to a physical location but instead to an account opened with a bank. By opening an account, you agree that the bank can hold your money in its reserves. Your checking account is the primary destination for the money you earn from your job. Your employer can deposit the money there, which you can then withdraw right away.

Using your checking account

Now that we know its purpose, it is important to understand how you can use your checking account. As I said previously, the terms “deposit” and “withdraw” refer to putting money into and taking money out of your checking account, respectively.

Let’s say that you earned $2,000 in a month, and your employer has deposited this money to your checking account. To withdraw this money, you go to an ATM and use the debit card you received from the bank when opening your checking account. A debit card not only allows you to liquidate, or convert cash from, your checking account, but it also can be carried around and be used instead of cash in transactions.

While a debit card will be the method of accessing your checking account, it is also possible that you receive an ATM card and personal checks instead. These, as opposed to a debit card, are only used to make purchases through your checking account and they can’t be used for everyday transactions, except at locations that take a check, like supermarkets.

Why have a checking account?

Based on what I’ve said so far, you can probably guess that a checking account is essential to have. There are three main reasons why you would want to have a checking account.

First, the world is digital nowadays. Especially with the COVID-19 pandemic, online shopping has become more popular. Amazon requires a debit or credit card to be attached to your account when buying a product, which you can only do by having a checking account.

Second, you get access to your money quicker. Virtually any bank offers mobile banking, which allows you to see how much money you have in your account. It additionally keeps track of what you recently spent money on; you can use this information to manage your spending habits.

Third, a checking account keeps your money secure. If you prefer to use cash only, you risk losing your money by simply forgetting your wallet or having it stolen. With a checking account, your money sits securely in the bank, and even if your debit card is stolen, you can notify the bank. They will deactivate the card and send you a new one.

Disadvantages of checking accounts

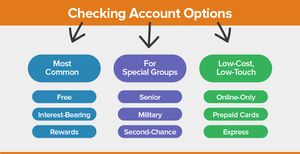

With its great benefits, checking accounts also have a few drawbacks. To keep a checking account, you need to pay maintenance fees. Luckily, if you are a high school or college student, many banks waive this for you. High school students, however, cannot open checking accounts on their own and need a parent sponsorship to do so. This is called a joint account.

Opening a checking account

You can open a checking account with any bank by filling out an application online or by visiting the local branch of a bank. However, the part that most people miss when going through this process is the required documentation. To open a checking account (in a student’s case, a joint account), you need your social security number and a government-issued ID (like a driver’s license or Real ID). When you open a checking account, there is a minimum deposit that you have to make to start using it. This amount varies, but most of the time, it is $25.

Conclusion

Checking accounts are essential to personal finance. Opening and maintaining one is very common and more importantly, beneficial. Whether you are a student who is just starting to explore personal finance or an adult looking to understand more about managing money, a checking account is one of the best first steps you can take to achieve your financial goals.